by: Mark D. Milbrod, CLU, CLTC- July, 2019 ASG Insight

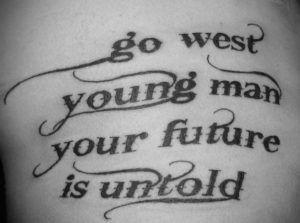

The iconic phrase “Go West Young Man,” was coined by Horace Greeley in the mid 1880’s. It concerned America’s expansion westward and the opportunities that existed for people to find their fortunes.

Today, a huge opportunity exists for the Insurance Advisor and you don’t have to go west to get it. In fact, you can go East, West, North or South. I’m referring to the Policy Audit space. Policy Reviews (or audits), are at an all-time high on the opportunity scale.

The best part of conducting policy audits is that the person we are talking to is already a buyer. Our goal is to see if we can create an outcome that either lowers cost, gives greater value or addresses new needs that could have come up since they last purchased their insurance.

When looking at current policies, there are many reasons why the Policy Audit is important. The life insurance industry has changed dramatically over the last few years. There have been many product innovations, especially through the introduction of living benefits.

In short, when trying to start the conversation of Policy Audits, a good question to ask is…” Do you have the old kind of insurance or the new kind?” That should easily get the client interested. This is a great chance to introduce some of the newer living benefits such as Long Term Care, Chronic Illness or Return of Premium Riders that were likely not available when the original policies were issued.

Here are some other areas where a Policy Audit can help:

Health Changes – it always pays to look at a policy issue class and understand why a policy was originally rated. With advances in underwriting, many risks are assessed more favorably today.

Rescue underwater contracts – Older contracts that had poor guarantees or are simply underperforming, such as UL & VUL contracts, can be replaced with stronger, sometimes full guarantees.

Needs change – The original intended purpose for the insurance could have changed. Perhaps It was designed to replace income when children were younger and are now grown. The need can now be lessened and repurposed into a newer plan with benefits like a Long Term Care Rider that better suits their current changed need.

Ownership & Beneficiary Issues – Often times there is improper ownership or beneficiary arrangements. Without making changes, there can be unintended tax and legal consequences.

Policies can be sold – For older insureds that once purchased policies that are no longer needed, don’t settle for cash surrender values. There may be a chance to sell the policy as a life settlement. This option should be explored as it may yield a significant windfall for the policy owner.

1035 Exchanges – One of the largest opportunities today is to utilize cash surrender proceeds and 1035 those funds into a newer contract with LTC Riders. This can act as a huge subsidy by providing LTC benefits at a greatly reduced cost.

This just scratches the surface when it comes to the opportunities that exist with Policy Audits. The problem is that advisors are not using them enough. As Horace said, GO WEST (the East, North & South as well).

If you want to learn more about how to use Policy Audits in your practice and increase your sales, click here and join us on August 14th at 10:00 AM for our next webinar…TAKING THE BITE OUT OF POLICY AUDITS.