by: Mark D. Milbrod, CLU, CLTC

Sales Vice President

With change comes opportunity. And so is the case with The Secure Act. Setting Every Community Up for Retirement Enhancement Act of 2019 was approved by the Senate on December 19, 2019.

Here are the key highlights…

- The SECURE Act will make it easier for small business owners to set up “safe harbor” retirement plans that are less expensive and easier to administer.

- Many part-time workers will be eligible to participate in an employer retirement plan.

- The Act pushes back the age at which retirement plan participants need to take required minimum distributions (RMDs), from 70½ to 72, and allows traditional IRA owners to keep making contributions indefinitely.

- The Act mandates that most non-spouses inheriting IRAs take distributions that end up emptying the account in 10 years.

- The Act allows 401(k) plans to offer annuities.

As a life insurance producer, the biggest takeaway for me is the clawback on the stretch IRA rules for non-spousal beneficiaries and the minimum age for RMDs being pushed back to age 72. Prior to the enactment of The Secure Act, non-spousal beneficiaries were able to stretch out the taxation of inherited IRA’s during their lifetimes. Now, those same beneficiaries will be limited to only 10 years.

This opens up a tremendous opportunity for some additional life insurance and annuity sales. Here are some considerations. If holders of qualified buckets of money…

- do not require those assets to maintain their lifestyle and

- are planning to pass on those assets to non-spousal beneficiaries,

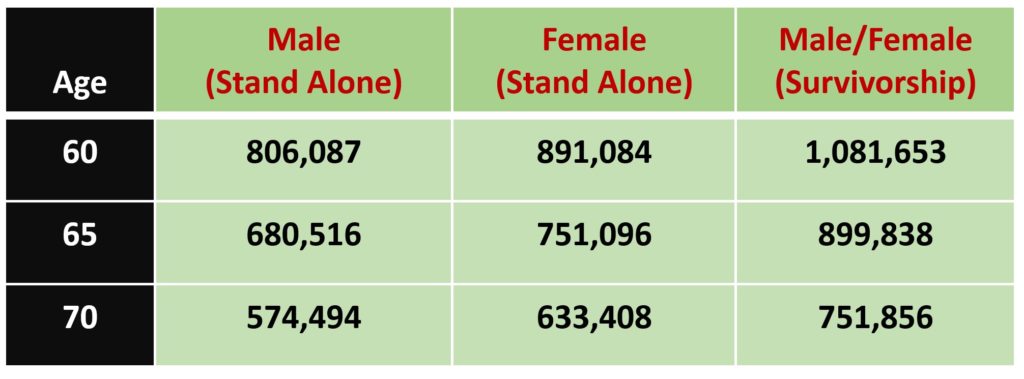

then consider leveraging those assets with the purchase of tax-free life insurance. It’s no different than the old Pension Maximization strategy. But with The Secure Act being in the news as much as it is, we have a tremendous opportunity to create new sales. Whether you use an Individual or a Survivorship Life option, the leverage is measurable. See the chart below to give you an idea of the kind of leverage you can expect to see. The example assumes a $500,000 qualified account balance purchasing an immediate income annuity with a 10 Year Certain Only payout option…

TAX FREE DEATH BENEFIT LEVERAGE

The notion of leveraging taxable dollars into tax-free alternatives is always a great story to tell. You can further enhance this opportunity by adding a Long Term Care or Chronic Illness Rider to compound the benefits of the transaction.

The SECURE ACT has definitely provided us with a huge opportunity with both Life Insurance and Annuity sales. Make CPA’s aware of this opportunity so as they prepare returns during the current tax season, they can identify clients that can take advantage of this planning technique.

We are ready to answer any questions on how you can start the conversation and get off to a great start in 2020.