By: Mark D. Milbrod, CLU, CLTC

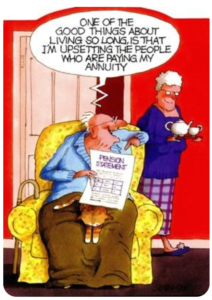

Annuities are the worst planning tool! They can do unspeakable things like…

- Guarantee competitive high rates of interest

- Act as a safe market hedge

- Can guarantee to double for income purposes

- Can guarantee income for as long as you (and/or) surviving spouse live

Yeah! Annuities are a horrible thing to have as part of a well balanced portfolio. All of those benefits listed above are just a sampling of the useless advantages that you can get from them. So why would you ever consider purchasing one? Here’s why…

Unfortunately, when the word “ANNUITIES” are thrown into the mix, there is usually negativity that surrounds it. Annuities are probably one of the most misunderstood financial instruments. Like any financial tool, annuities, if used properly, can play an integral part of a well structured retirement plan.

There are many different types of annuities that are available in the marketplace. They come in many different forms; deferred, variable, fixed, etc. You have to be very careful with some contract designs that have huge fee and expense charges, so knowing the nuances between products is very important. However, a plain vanilla Multi Year Guarantee Annuity (MYGA) can provide contract holders with a competitive, safe & dependable guaranteed interest rate that talks to a risk averse client base. Especially as we continue in the current low interest environment, when compared to other fixed alternatives such as CD’s and other cash equivalents, Annuities can greatly outperform these options.

But annuities are much more than that. Annuities can be used creatively to help your clients with a number of unique planning solutions.

Single Premium Immediate Annuities (SPIAs) are one of the most underused planning tools. They are extremely versatile and be used effectively in so many sales scenarios.

Market Downturns

In the case where you have clients that have lost money in the market and have not fully recovered, SPIAs are a great way of making up the difference without risk. The downturns probably impacted their ultimate desired amount of retirement income and a SPIA can be utilized to fill in those gaps and possibly put them back to where they planned on being.

SPIA/Life Combo

If clients have non-qualified funds that are not needed, you can take income (annuitize), pay the tax and with the net income, make gifts and purchase trust owned life insurance outside of the taxable estate. This technique is extremely helpful with respect to transferring assets to the next generation. (Note: Older life insurance contract cash values can be transferred via a 1035 Exchange into annuity contracts (i.e. SPIA’s), maintaining the integrity of basis and lowering the taxable portion that is being distributed.)

RMD Scenarios

For clients that are taking Required Minimum Distributions (RMDs) from IRA assets when they turn 72, SPIAs can be a helpful tool. The qualified funds can be annuitized and the income generated will be fully taxable on an annual basis but the corpus of money will be out of the taxable estate. In this scenario, the net proceeds (out of the IRA), can be used to purchase life insurance. The net result is a significant amount of income tax savings and the heirs can ultimately receive a greater amount of assets tax free. This has driven greater interest after The Secure Act was enacted that limited Qualified distributions to Non-Spousal beneficiaries.

Competing with Guaranteed Income Benefit Riders

There is a lot of talk about the Guaranteed Income Benefit Riders, which can be costly. Often times if you compare the Guaranteed Income payouts to that of a SPIA, the SPIA incomes are guaranteed on a higher level. It is worth comparing if you have any situations like this.

Longevity Planning

One of the major concerns of people today is outliving their retirement assets. A huge benefit of a SPIA is that you cannot outlive the income stream. Whether you live 5 years or 50 years, the income will continue for your lifetime. This can easily be set up for a husband and wife so that the income will continue until the second spouse passes. (Note: When structuring life income payments, a common objection is that if the annuitant(s) dies, payments cease.

We never implement a payout option without an Installment Refund. This assures that if the annuitant(s) die prior to receiving at least a return of the annuity purchase amount, payments will continue to a named beneficiary until that threshold is satisfied).

Multi-Generational Gifts

SPIAs can also be used to pay income on the life of multiple annuitants. Perhaps a grandparent wants to provide income to a grandchild. Funds can be deposited into an annuity with both listed as annuitants. Even after the grandparent passes, income can continue for the life of the grandchild. This can be a great way of being remembered for years to come.

Something else to consider, SPIA’s can also be used to either fund fully or defray the cost of Long Term Care premiums. We have been repurposing funds that were earmarked to cover “self-funded” long term care expenses. By utilizing those dollars into annuity, and funding some type of LTC or Hybrid LTC product, we are able to create a much larger leveraged bucket that provides far more LTC benefits.

Another area where annuities can be extremely helpful is using the “Guaranteed Roll-up” Options.” These options, usually found within Fixed Indexed Annuity Contracts, you can guarantee that the annuity deposit, in some cases, will double for income purposes in as early as 10 years regardless of market conditions. The older an annuitant, the higher the eventual income payout. This can be a great longevity hedge or used to fund future life insurance and/or LTC policy premium in the future. Either way, it can be an extremely effective strategy.

As you can see, annuities are a horrible tool.

In actuality, annuities are misunderstood and not utilized to their full potential. They offer a wide range of planning opportunities and if used in the right situation can help a number of clients achieve and protect their financial security.

The above is only a sampling of how annuities can be used effectively in a well-constructed financial plan. For more information on how to incorporate annuities into some possible sales situations, call us today.

Awesome article bro….