by: Mark D. Milbrod, CLU, CLTC

When I look back at this industry, I am amazed at how far it has come. The changes and innovations that have taken place have transformed how we conduct our business. Most industries have experienced a great deal of disruption and the insurance industry is no different.

With advances in technology, there has been a change in underwriting philosophy. The application process has changed dramatically. It used to be that for a run of the mill life insurance application, the proposed insured would have to have a paramed exam completed to include a blood & urine sample, a possible EKG as well as medical record retrieval. In addition, the actual application was very long and often times was not filled out correctly, which significantly slowed down the entire process.

Today however, if you are between the ages of 18 – 60, you can often secure up to $1,000,000 of life insurance benefit for either term or permanent insurance plans without a medical exam. In fact, in some cases, you may be able to secure as much as $5,000,000 non-medically.

This is where the technology kicks in…

When applications are submitted, extensive searches are being completed behind the scenes. The insurance carriers are able to conduct searches by accessing a number of databases that provide valuable information. This information can include, but Is not limited to, state motor vehicle records, prescription drug histories and property/personal data. With all of this information at their disposal, the carriers save countless dollars on acquisition costs associated with the application and underwriting process.

All of this provides a more efficient, shorter underwriting process resulting in very quick approvals compared to older methods. This gets your client their policy faster and gets you paid faster as well.

The title of this post was “But Wait…There’s More!

So here’s the MORE…

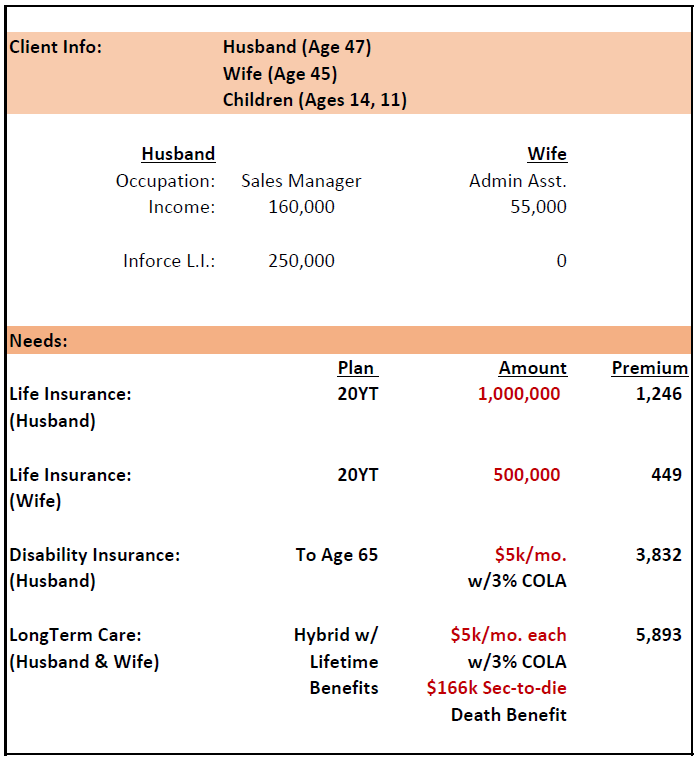

This Non-Medical business applies to a large segment of the products we sell. Here is an example of a recent case that utilized all of the benefits of “non-medical underwriting for not only Life Insurance, but Disability Income & Long Term Care Insurance:

Under the above scenario, we were able to work with these clients and take advantage of all of their needs on a Non-Medical basis – NO BLOOD, URINE OR PARAMED. All of this was achieved with short form, simple applications and a brief phone interview.

When you tally up all of the numbers, a total of $1,666,000 of life insurance benefit, $5,000/mo. of disability income benefits and an uncapped long term care benefit for each of the insureds starting at $5,000/mo. was provided.

I started out this post by stating how amazed I am with our industry. The new approaches in underwriting afford us tremendous opportunities in providing our clients with unique solutions to their planning needs. Cutting out the exam and other physical requirements greatly reduces the time it takes to process a piece of business. It also can motivate clients to move a little faster.

If you haven’t taken advantage of the full scope of this new way of doing business, you should give it a try. But Wait, There is More…

More opportunity and more cases to close.

Find more of Mark’s Bark’s Blogs on our website: http://www.asglife.com/insurance-view/marks-barks-blog/