By: Mark D. Milbrod, CLU

By: Mark D. Milbrod, CLU

Partner, Agent Support Group-1-2018

It’s a new year and with it, the slate is wiped clean for all of us in sales. Regardless of what we have done (or didn’t do), we start fresh and have to work on a new set of goals. If there is one constant that exists, it is that every new year brings with it some interesting changes. 2018 is no exception. The new Tax Cuts and Job Act is causing a bit of a stir, but in the end there are a host of opportunities that lie beneath the surface.

Of those opportunities, it seems that the doubling of the Estate Tax Exemption, an additional $5,600,000 for an individual or $11,200,000 for a couple, will be the area where the most planning will take place. There is a window until 2026 and I would imagine that this will be where the greatest amount of activity will occur (if you have clients in that arena).

If we move the Tax Cuts and Job Act aside, I believe that the largest single area of focus for this year should be the Long Term Care marketplace. Simply stated, everyone needs to have it as part of their financial plan. It doesn’t really matter what tax bracket you are in, the need exists for all. When I reference Long Term Care, I am not referring to the Stand Alone/Traditional models. The market for those products has contracted to the point where there only a few carriers left and for those carriers that still have a product, they are cost prohibitive and offer no guarantee of future premium.

The opportunity exists with the Life Insurance products that offer Long Term Care Riders or Chronic Illness Provisions. The most common design options are:

- Guaranteed Universal Life with Long Term Care Riders

- Indexed Universal Life with Long Term Care Riders

- Whole Life with Long Term Care Riders

- Hybrid Life Contracts (i.e. MoneyGuard)

These product designs are very unique and offer guaranteed premium structures as well as “non-forfeiture type” provisions that will ultimately pay a death claim to beneficiaries if a Long Term Care Claim never occurs during the life of the contract. This is in contrast to a Traditional/Stand Alone policy that carries a “use it or lose it” approach to benefits.

These types of products also allow for many planning opportunities for a multitude of different client groups. As an example, for Business Clients, these products can be used for Buy/Sell Planning where the benefits can be used to replace lost income to partners, provide for dollars needed to hire a replacement or for a “quasi buy-out.”

Because they are linked to a life insurance product, it is also possible to provide Long Term Care benefits at a sub-standard rate that you normally could not receive with a Stand Alone LTC policy.

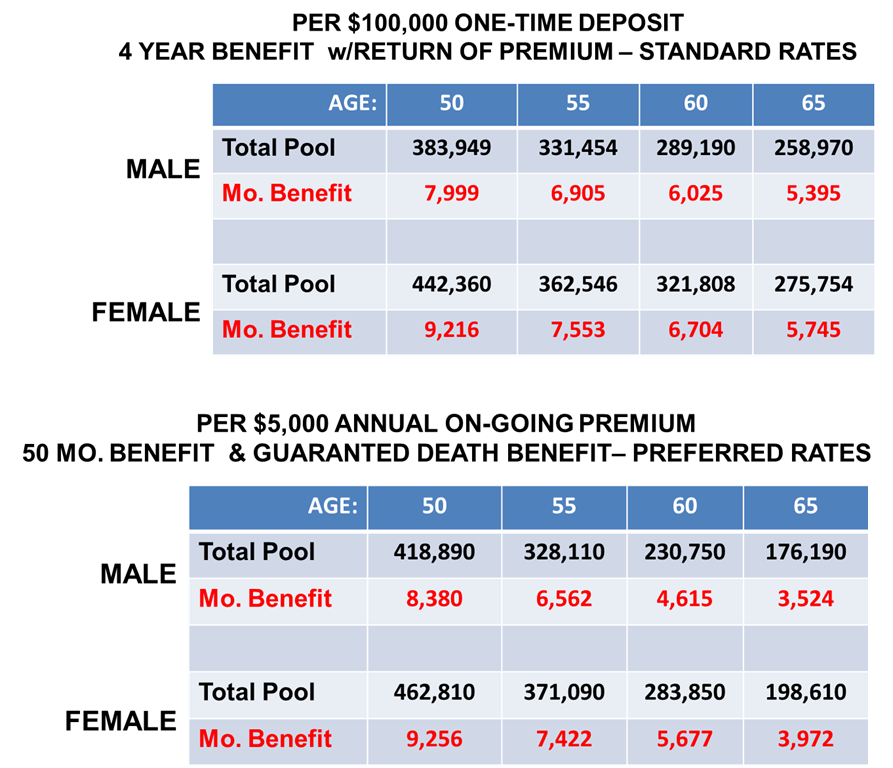

We often hear the argument that clients can simply “self-insure” their LTC Needs. Dismissing the fact that most clients do not or will not have enough funds to do so, below is a chart showing the power of leveraging LTC Benefits based on either a Lump-Sum Premium Hybrid Product ($100,000) or paying with an on-going premium structure ($5,000/year). As you will from the charts below, the Tax-Free DB/LTC Pools and potential Monthly Benefits are quite large:

The versatility of these types of products appeal to a very wide range of client bases. There are even options that allow you to procure a Survivorship Life contract with a parent/adult child and use the joint issue age for premium purposes and provide “un-capped” LTC pools.

With an aging population and illnesses like Alzheimer’s and Dementia expected to hit record highs over the next 20 – 30 years, these products will definitely be a huge part of your sales conversations in the coming year and beyond.

When I first started in the business, my Sales Manager told me to buy a policy on my own life. I did and carried it around with me to sales calls. I was able to show my prospective clients that I was not just a salesman, I was a policyholder as well. A good place to start would be to run some quotes on your own life. See the process, and in the end, you will be able to speak from experience and show your clients that you believe in what you are selling.

There are obviously many different scenarios where these products fit. We have created a number of sales materials to assist you in this marketplace. We have even created a Retail Seminar that can be used to larger groups of prospective clients. Give us a call to review this in more detail and see how you can make this opportunity a huge part of your 2018.

Happy Sales and all the best for a Healthy and Prosperous New Year.

Find more of Mark’s Bark’s Blogs on our website: http://www.asglife.com/insurance-view/marks-barks-blog/