by: Mark D. Milbrod, CLU

by: Mark D. Milbrod, CLU

Partner, Agent Support Group-March 2018

“A society grows great when old men plant trees whose shade they know they shall never sit in.” – Greek Proverb

As you are reading this today, there has been a large shift in the markets that we cater to. The 2017 Tax Cuts and Jobs Act was one of the largest changes to the tax code that we have experienced in a very long time. It has changed the attitudes of our prospective “buying” clients and has set the stage for different conversations.

The general public thinks that “Estate Planning” is something that was only for the rich and wealthy. That couldn’t be farther from the truth. In fact, everyone needs to do Estate Planning. If you own something, you need to have a plan. In its simplest form, an estate plan provides a road map to who gets your “stuff,” when they get it, who handles it and most importantly, sees to it that it gets where it needs to be in accordance with your wishes.

Of course there are many legal instruments that can be used to direct assets to the proper parties, such as Wills & Trusts. The bottom line is to make sure that assets get to where you want them to be. The opening part of this post shows a Greek Proverb that I came across some time ago and the words are very fitting as it relates to Estate Planning and Leaving a Legacy.

Through the planning process, and as a compliment to those legal documents, there are many things that can be done with the products and services that we provide to assure a lasting, meaningful legacy to the ones we care about the most. Here are just a few examples:

Parents Legacy to Children/Grandchildren:

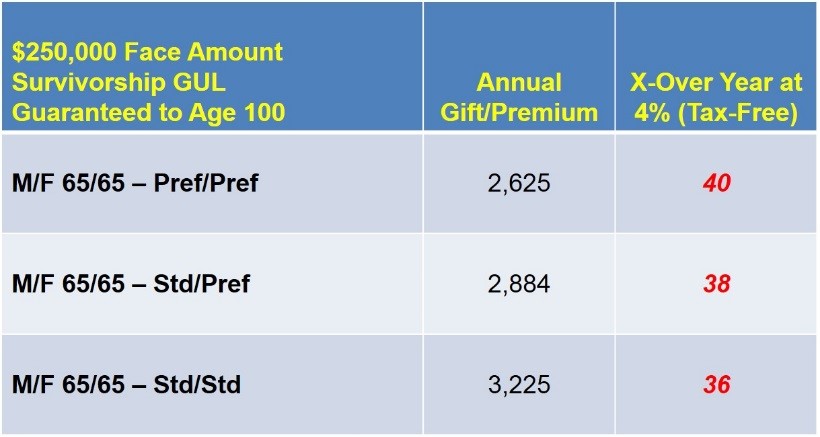

It is often overlooked that annual gifts (measured by small annual premium payments), can leave large leveraged face amounts to children and grandchildren. Take a look below at a chart showing the power of leveraging those small annual premium payments. Using a $250,000 Survivorship Life GUL, the buying power is very strong. It is 100% guaranteed with no market risk.

Grandparents On-Going Gift:

By purchasing a life insurance policy on the life of a grandchild, they can provide a lifelong source of income that can be used as a vehicle to take money out during defining moments in that child’s life such as funds for college, a marriage or the purchase of a new home.

Also, an annuity can be purchased today that can be designed to release funds every year for the life of the grandchild. This kind of transaction has psychological implications. Long after the grandparent passes, each and every year monies are received and they will always be remembered.

Concentrated Stock Positions:

Sometimes we run into a situation where a client has a large concentrated stock position. We then ask what the ultimate goal is. Most times, it will be left to heirs.

In these situations, it may be advisable to liquidate that stock, take the net proceeds and procure a Guaranteed Life Insurance contract in its place. By implementing this strategy, we take out the market/timing risk component and can provide significantly higher tax-free distributions to heirs upon death, which significantly increases their legacy via the leveraging position of the life insurance.

Leaving a Charitable Legacy:

In cases where a client is charitably inclined, don’t forget the value of leaving a charitable legacy. The same rules apply to the leveraging component. Through life insurance proceeds, large amounts of assets can be left to causes that are near and dear to people and through that, they live on.

As an example, in a local township, a large amount of life insurance proceeds were left to a youth baseball league upon the death of its founder. He had been involved with the organization for over 40 years. They always had dreams of a huge, state of the art baseball park, but had limited means throughout his lifetime to do so. Through the utilization of a life insurance policy, a large endowment was created and a park was built in his name.

These are just a few examples of how to utilize the products and services that we provide for the purposes of leaving a legacy. Of course there are other ways in which we can provide a legacy, but this is a good sampling of how we can make a difference.

As the proverb stated at the beginning of this post, the one leaving the legacy may never sit it in the shade of that tree they planted, but the legacy they leave behind can provide that shade for many years to come.

Find more of Mark’s Bark’s Blogs on our website: http://www.asglife.com/insurance-view/marks-barks-blog/