By: Mark D. Milbrod, CLU,CLTC

If you are looking for a way to keep up production for the summer months, one of the best ways to do that is to not forget good old fashioned Policy Reviews. Whether you are talking to existing clients or trying to find some new prospective clients, always ask to review their current coverages.

One of the easiest approaches is to ask a client is they have any inforce insurance policies. If they do, you know one thing already…THEY ARE ALREADY BUYERS! People will typically refinance a mortgage; review their auto or homeowners policies on a regular basis. This is typically done in an effort to save money. When performing a policy audit/review, you may be able to save a client premium dollars but more importantly, you can introduce some of the newer types of life insurance plans that have some additional features that may not been available when they first purchased their insurance.

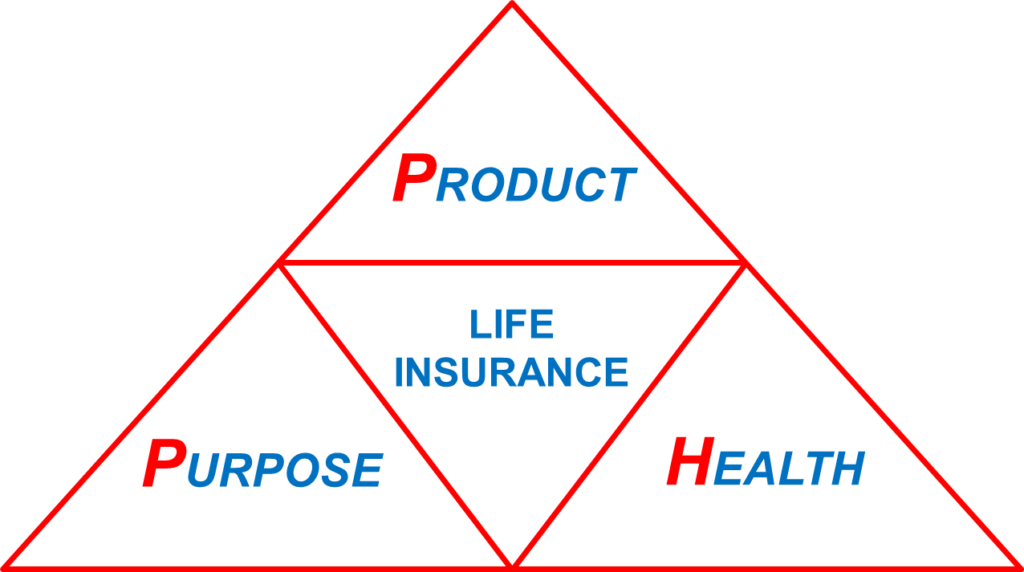

When reviewing inforce policies, we utilize a technique called The PPH Process

(or Product- Purpose-Health Review)…

This notion of a policy review may sound simplistic but most advisors have been overlooking the opportunities that exist. Here are some key points to consider:

Health Changes

When trying to review life insurance policies, it is important to keep in mind that health changes can make the largest impact for your clients or prospective clients. One of the most common changes can be someone’s smoker status. We come across so many policies that were purchased when insureds were smokers. Keep in mind that if someone has not smoked for only one year, you can start introducing non-smoker rates. This makes a huge impact on premiums. Additionally, look out for cigar and alternative tobacco users that have current policies rated for smoking that can also be considered as non-smokers. Other impairments such as cardiac or cancer histories can be considered as Standard or better rates once time has elapsed on previously rating cases.

Rescue Underwater or Underperforming Contracts

There are older Current Assumption or Variable Life contracts that are either under water or have limited guarantees compared to newer fully guaranteed contracts. There are also opportunities with older policies with cash value that can be transferred via 1035 Exchanges. In any of these situations, you can improve a client’s position with either greater guarantees or lower out-of-pocket outlays.

Needs Change

Let’s not forget that needs change over time. Perhaps there was a need for life insurance that was earmarked for a specific need that no longer exists. Clients may need to “downsize” their insurance as those needs change or repurpose them into other, newly formed needs such as Long Term Care protection. Taking advantage of 1035 Exchanges can be a valuable tool in these situations as well.

Obviously, there are many situations where a Policy Review can be beneficial to a client. As simple as this sounds, many advisors overlook this. As we enter into the summer months, consider this as great way to stay busy and generate substantial opportunities during a time that is typically slow for most. To learn more about The PPH Review Process and how it works, contact us today.

And don’t forget…

To Review or Not to Review…That is the question!